Opening a fixed deposit is really good way to invest your money and get good amount of return for the money you have invested. We all want to be rich and to get rich we need to invest our money to increase the amount of money which we have with us. When it comes to investment there many places where you can invest your money where your money grows, but the main thing is when you invest your money anywhere the first thing you need to check is risk. How much risk are you taking with the money which you have invested there?

KDR means Kamadhenu Deposit and FDR is normal Fixed Deposit. In KDR, the interest is not credited or paid to the customer at agreed intervals during the life of the deposit. Canara Bank FD Interest Calculator is an online financial tool that allows you to calculate the maturity value of your fixed deposit at the interest rate offered by bank. The amount of FD, interest rate, deposit tenure and compounding frequency of interest together determine the maturity amount of the FD at the end of the tenure.

We should always check the risk level while investing our money somewhere. And today I will tell you a complete new way where your money will grow with time i.e. you will get good amount of returns for your money which you are investing. But the risk level here is very less! Yes you heard it right the risk level is almost zero here. I am talking about Fixed Deposits. If you are searching online for an article in which you will find information about how to open Fixed deposit in Canara Bank. Then let me tell you that you have been landed on the right website here. Because in this guide on Online Indians you will find how you can open fixed deposit in Canara bank.

Canara Bank Fixed Deposit Form

Contents

Things you should know about Fixed Deposit.

But before we proceed to the further part of this guide I would like to tell you few things about Fixed Deposits before you open one for you.

- In this guide you will find the procedure which you need to follow to open fixed deposit in Canara Bank offline process and not online.

- The minimum tenure or term period for which you can make Fixed Deposit is 7 days.

- The maximum tenure or term period is 10 Years.

- When you open a FD and it gets matured, if you don’t visit your home branch where you had opened your FD, it will be automatically renewed.

- The name on the FD account should be exactly same as on the savings bank account to which you want your FD amount to be funded.

How to Open Fixed Deposit in Canara Bank?

So now let us get started with this guide and check out how you can open Fixed deposit in Canara Bank. I have mentioned all the steps which you need to follow, after reading this guide if you have any kind of doubts in your mind you can leave your comment below.

- The first thing you need to do is collecting the FD form, you can download this form online or else you can visit your Canara Bank home branch and ask them for the form. You will get it there.

- Filling FD form, now you need to fill the form with all the details which are asked to you in the form.

- After that you need to collect the documents which you need to submit to your bank.

- Documents: You need to submit photocopies of your PAN card and address proof documents.

- Make sure you make your signature on the photocopies of your documents. Because without your signature on them they will not be considered as valid documents.

- When you have completed filling the form and collecting your documents, visit your home branch.

- Talk with the bank officials and show your form and photocopies of your documents and verify with them if you have taken the right documents and filled the form correctly.

- Now deposit your the amount of which you are making FD.

- Once you have done with depositing your amount in Canara bank, you are done with it.

Final Words.

So this was how you can open Fixed Deposit in Canara bank, I hope you are clear with all the steps which I have mentioned in this guide. As I have already mentioned if you have any doubts you can comment below. I will respond to your comment as soon as possible. And if you want to get assisted quickly you can visit your Canara bank home branch during working hours. They will assist your with the procedure.

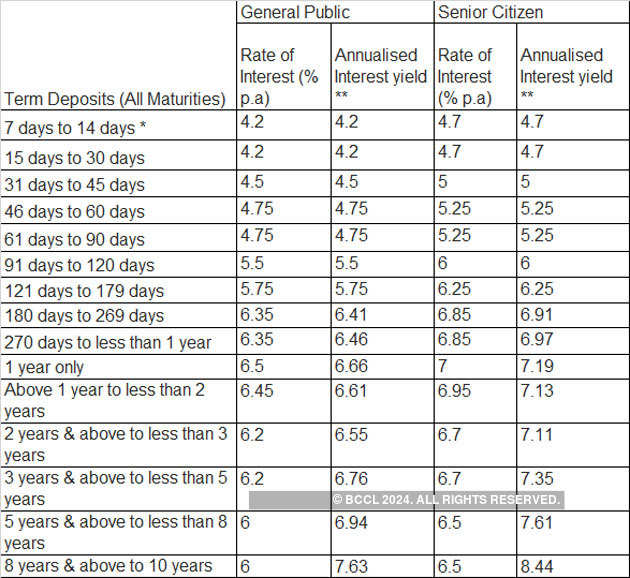

Canara Bank FD Rates: Check Latest updated Best FD Interest Rates, RD (Recurring Deposits) Interest Rates, Single Term Deposit Rates for General, NRI & Senior Citizens Online through Deal4loans.

Latest Updated Deposit rates News:

✓ Bank Offers 5.40 % p.a. for Canara Tax Saver Deposit scheme (General Public). Maximum deposit acceptable is Rs 1.50 Lakh.

✓ You Can Invest As low as Rs.1000/- Per Month

✓ Minimum 15 days (7-14 days – Only for single deposit of Rs.5 lakh and above), Maximum 120 months

✓ Additional interest rate of 0.50% uniformly across all maturities for Senior Citizens

✓ Loan Facility Available upto 90% of the deposit amount

Eligibility:

Individual, Joint (not more than 4), a Guardian on behalf of a minor, HUF, Partnership, a Company, Association or any other Institution

Canara Bank Fixed Deposit Interest Rates February 2021

| For Deposits less than Rs.2 Crore w.e.f. 08.02.2021 | ||

Term Deposits (All Maturities) | General Public | Senior Citizen |

| Rate of Interest (% p.a.) | Rate of Interest (% p.a.) | |

| 7 days to 45 days* | 2.95 | 2.95 |

| 46 days to 90 days | 3.90 | 3.90 |

| 91 days to 179 days | 4.00 | 4.00 |

| 180 days to less than 1 Year | 4.45 | 4.95 |

| 1 year only | 5.20 | 5.70 |

| Above 1 year to less than 2 years | 5.20 | 5.70 |

| 2 years & above to less than 3 years | 5.40 | 5.90 |

| 3 years & above to less than 5 years | 5.50 | 6.00 |

| 5 years & above to 10 Years | 5.50 | 6.00 |

Compare Fixed Deposit Interest Rates

Check HDFC Bank FD Interest Rates

Latest SBI Fixed Deposit Interest Rates

Compare Ratnakar Bank Fixed Deposit Interest Rates

Get Indian Bank Fixed Deposit Interest Rates

Canara Bank Interest Rate

Call Canara Bank Toll Free Number – 1800 425 0018

Comments are closed.